My graduated brother became CEO through our parents and fired me. The next day began the real story.

My name is Kendall Shaw, 32, and until this morning, I was COO of Shaw Riverfront Logistics. The boardroom door hadn’t even clicked shut behind me when my brother’s voice sliced the air.

“We don’t need someone living off legacy, Kendall.”

Eastston—twenty-five, fresh NBA Rolex glinting under the Memphis sun streaming through the 12th‑floor windows—didn’t wait for silence. He pointed straight at me.

“Clear your office by tomorrow.”

Our father, the CEO, sat motionless at the head of the table. Last year, he’d quietly transferred his voting shares to Eastston. I’d kept producing results, so no one questioned it until now. The three outside directors stared at their laptops. No one blinked.

I nodded once, stood, and walked out. If your own blood has ever stabbed you in the back at work, smash like and subscribe. Tomorrow morning is when the real story explodes.

The next morning, 7:15 a.m., I swiped my badge at the executive elevator and rode to fifteen in silence. The doors parted with a soft chime, and the motion lights activated ahead of me, guiding the way to the glass entrance of my corner office. I pushed through the door, sealing behind me with a pneumatic hiss.

Emerson, my assistant for the past seven years, was already inside, perched on the edge of the reception desk, holding a steaming takeaway cup in one hand and his phone in the other.

“Kendall, your brother has completely lost it. You personally constructed nearly 40% of the high‑margin lease portfolio—the true revenue powerhouse—starting when you were just twenty‑four years old. He can’t simply delete a full decade of strategic pipeline with one dramatic boardroom declaration.”

I didn’t respond immediately. I crossed the open area in measured steps, heels muted on the high‑grade concrete flooring. At the far end, I knelt beside the sleek credenza and placed my thumb on the biometric scanner embedded in the wall safe. The panel unlocked with a quiet click and slid aside.

Inside rested one item—a thick expandable redweld folder, corners worn from repeated access, label handwritten in my precise block letters. I extracted it carefully and placed it flat on the expansive desk surface.

“KS Warehouse Advisers LLC,” I said, flipping open to the official incorporation documents stamped exactly four years earlier. “I established this entity as a tax‑efficient pass‑through vehicle specifically for optimizing leases that span multiple jurisdictions and state lines. Every single flagship contract explicitly names it as the contractual lessor, creating a deliberate separation from the core operating company.”

Emerson stepped closer, leaning over to examine the densely packed rider pages. “The board actually reviewed and approved these amendments. They initialed every individual rider and schedule. They focused on phrases like ‘accelerated depreciation benefits’ and ‘like‑kind exchange structuring’ and never looked beyond the controlling entity designation at the very top. Never prompted any follow‑up questions or concerns.”

I navigated to the comprehensive portfolio summary sheet. “Twenty‑three currently active lease agreements. Combined controllable square footage under management, 4.8 million. Current annualized revenue run rate, 28.4 million, demonstrating a consistent 9.3% compound growth rate across the previous six consecutive quarters.”

Emerson exhaled slowly through his teeth. “That segment is the absolute profit lifeline.”

“Correct.” I folded the redweld shut, inserted it into the waiting slim carbon‑fiber briefcase positioned on the adjacent visitor chair, and secured the dual combination locks with two distinct clicks. “And the lifeline has officially been redirected to new ownership.”

He moved to the floor‑to‑ceiling window, hands shoved deep into his pockets, observing a long towboat pushing three loaded barges southward against the current. “The standard renewal cycle commences in exactly ninety calendar days. Apex, Covenant, Delta—they all mandate your proprietary dynamic routing tables and lane optimization models. They will not execute blind commitments without confirmation.”

“They will receive full confirmation.”

I rotated the safe dial multiple times until the internal bolts engaged fully, then slipped the mechanical override key into the inner pocket of my blazer. Identical algorithms, simply operating under a different contractual lessor.

Emerson turned back to face me directly. “You are formally activating the full contingency protocol.”

“The protocol activated the moment Dad executed the voting control transfer last year.” I retrieved my tailored coat from the discrete wall hook. “I merely engineered the release mechanism in advance.”

He nodded once, absorbing the implications. “The mechanism is now fully deployed, completely operational.”

I checked the minimalist wall clock. “7:29 sharp. Inform facilities management that I will be fully vacated by eleven hundred hours. No packing cartons, no external movers required. One briefcase only.”

Emerson paused at the office threshold for a brief moment. “Kendall… your parents.”

“Parents do not execute lease throughput commitments,” I said, moving past him into the brightly lit hallway. “Shippers and tenants do.”

The elevator car arrived within seconds. I selected G for garage level. The descent was smooth and uninterrupted. At the sub‑level lobby, security personnel acknowledged my exit with a casual wave. No additional badge scan needed for departure.

I traversed the climate‑controlled plaza, descended the dedicated garage ramp, and located my sedan in the assigned executive slot, C4. I placed the briefcase on the passenger seat, started the engine with a low purr, and engaged reverse. The backup camera displayed empty space. I navigated the spiral ramp upward, emerged into daylight, and merged smoothly onto Riverside Drive. The Mississippi River sparkled to my immediate left—calm, vast, unchanging. I had dedicated an entire decade to constructing and maintaining the family infrastructure barriers. Now the entire water flow belonged exclusively to my direction. I accelerated firmly eastbound, maintaining steady pressure on the pedal, and watched the headquarters building diminish gradually to a distant silver reflection in the rearview mirror.

That same afternoon, I was cruising east on I‑240, traffic light, when the dashboard console flashed: office landline auto‑forwarded to the vehicle Bluetooth system. I pressed the accept button on the steering wheel without taking my eyes off the road.

“Kendall Shaw. Craig Brooks, Apex Warehousing.” His voice carried the familiar warehouse den—forklift backup alarms, pallet jacks scraping concrete. “Eastston just shot out an email proclaiming he’s the new point of contact. Our master lease hits the sixty‑day renewal mark. We committed to your proprietary routing algorithms—eighteen percent hard‑coded savings. What exactly is happening here?”

“He’ll piece it together shortly.”

Craig made a sharp sound—half laugh, half growl. “The signature block isn’t tied to the family nameplate.”

“Send over the renewal package. I’ll circulate counter‑sign terms through the actual lessor entity before end of business.”

“Emailing now.” The line cut dead. I maintained lane position, hand steady at ten and two. Nine minutes ticked by on the dash clock. My personal mobile vibrated against the center console, caller ID displaying the CEO direct extension. I thumbed accept.

“Fire—hop—” static—“something.” Eastston’s words tumbled out fast, volume climbing. “Craig is refusing to extend without the original documents in hand.”

I eased into the right lane, signaling for the upcoming exit. “Four years ago, I completely reengineered the leasing framework from the ground up. KS Adviser functions as the dedicated leasing intermediary—a distinct layer designed for tax efficiency and liability isolation. Dad reviewed and initialed every rider, interpreting the structure as routine optimization.”

“No one at the time projected that the entity could sustain full independent operations. You can’t possibly—”

I terminated the connection. I navigated the off‑ramp, merged onto surface streets, and looped back toward downtown in under four minutes. I pulled into the visitor parking deck, slotted into an open space on level three, rode the elevator to fifteen. The hallway stood empty, fluorescent lights humming overhead. I inserted my key card, pushed the office door open one final time. The brass nameplate remained mounted: COO, Shaw Riverfront Logistics.

I produced a small Phillips screwdriver from the desk drawer, loosened the four corner screws, lifted the heavy plate free, and let it fall with a metallic clank into the waiting cardboard disposal box positioned beside the credenza.

Laptop powered down, I launched the secure erase protocol on the local SSD, monitored the progress bar crawl to completion, then disconnected all peripherals. Final visual sweep: filing cabinets—bare; whiteboard—cleaned; personal items—absent. I stepped backward into the corridor and pulled the door closed. The electronic lock engaged with a definitive thunk.

Back in the garage, I slid behind the wheel, reversed out of the spot, and descended the spiral ramp toward the exit barrier. The gate arm lifted automatically. I accelerated southbound. Destination: Germantown. The skyline faded behind me.

Two days later, Wednesday, 6:30 p.m., the front‑door camera pinged on my phone as the first SUV rolled up the driveway. I opened the door to Reed—project manager, ten years in the trenches with me—flanked by six others carrying laptop bags and rolled blueprints.

“Core team assembled,” Reed said, crossing the threshold. “Non‑compete only locks Tennessee accounts. Arkansas and Mississippi are wide open.”

I led them through the foyer into the living room—oak herringbone floors, sectional pushed back, eight folding chairs arranged around the low walnut coffee table. Reed handled quick introductions: three operations leads, two data analysts, one regulatory compliance specialist. All had tendered resignations at 9:00 a.m. sharp.

Lennon, my college roommate turned M&A counsel for warehousing transactions, arrived last, wheeling a slim aluminum briefcase packed with fresh drafts. We took seats. I connected my laptop to the 75‑inch wall screen and opened the KS Adviser pitch deck.

“Goal: validate the model at scale without legacy branding.”

I clicked to the site overview slide. “Two pilot warehouses—Little Rock and Jackson. Combined footprint, six hundred thousand tolerance square feet. Six‑month memorandum of understanding with purchase option at fair market value.”

Lennon distributed stapled copies. “Landlords pre‑qualified. Base lease rate locked fifteen percent below current market comps—contingent on our immediate occupancy and CAPEX commitment.”

Reed flipped to the equipment schedule. “Racking, conveyors, WMS integration—fully budgeted in the capital line. Turnkey installation within thirty days of move‑in.”

An ops lead raised a finger. “Routing engine and lane optimization software?”

“My proprietary codebase is already migrated to private cloud. Access keys issued upon execution.”

Lennon opened the compensation folder. “Base salary increased fifteen percent across the board. One percent fully diluted equity granted day one, four‑year linear vesting, full acceleration on change of control.”

The compliance specialist scanned the benefits page. “Medical, dental, 401(k) match—effective date one. Same carrier, upgraded dental plan, six percent match.”

Reed leaned in. “Go‑live timeline: occupancy in thirty calendar days. First inbound truckload forty‑five days post‑signature.”

A brief pause, then unanimous head‑nods. Lennon produced a stack of blue‑ink pens.

“Execution first, then individual offer letters.”

I signed the cover page of the top doc, dated it, and slid it clockwise. Seven signatures followed in rapid succession, each pen stroke deliberate under the warm recessed lighting.

Reed capped his pen with finality. “We are officially operational.”

Lennon gathered the executed originals. “Electronic filing with the Secretary of State tonight. LLC operating agreement amendment queued for tomorrow morning.”

I passed out the preprinted offer letters—names, titles, compensation figures already filled. Each team member reviewed, initialed the acknowledgment box, signed, and dated. Handshakes circled the table—firm, committed.

By 8:17 p.m., the group filed out, headlights sweeping the cul‑de‑sac. As engines started, I secured the deadbolt, poured a glass of water from the kitchen island, and spread the signed originals across the dining table for final review. Phase One, locked and loaded.

One week later, Monday, 9:00 a.m., my laptop pinged with an incoming Zoom link. Emerson appeared on screen, sitting in his home office—shelves of color‑coded binders behind him.

“Kendall, the board just called an emergency session for ten. Your name is the only agenda item—employment status clarification. They expect you in the 12th‑floor conference room.”

I muted the live drone feed from the Jackson pilot site streaming on my secondary monitor. “Decline. My calendar is blocked.”

He leaned closer to the camera. “Your father is running the meeting. The three outside directors are demanding a full report.”

“Understood.” I clicked End on the Zoom window.

The house phone rang instantly—caller ID flashing Mom Cell. I counted four rings before lifting the receiver.

“Kendall.” Patricia’s voice held the polished Southern drawl she reserved for bridge club and charity galas. “Your father wants you to come downtown and talk this through. Not as a former executive—as his daughter.”

I watched the Baton Rouge landlord’s shared‑screen cursor blink in the lease draft, awaiting my final edits on the indemnity clause. “Relay the message that I’m tied up in a critical negotiation.”

I rejected the auto‑populated board meeting invite on my phone. Patricia paused, the silence heavy.

“He’s concerned. We both are. Blood runs thicker than any contract, sweetheart.”

The landlord messaged in the chat box—Green light on final redlines. I replied: Advance to section 8.2, cross‑default provisions.

“Blood doesn’t retroactively rewrite board votes that strip a decade of documented revenue contribution,” I said, keeping my volume even. “I have a firm cutoff at 9:15.”

She exhaled softly. “Kendall, please.”

I placed the receiver back in the cradle, toggled the ringer to Do Not Disturb, and rejoined the Baton Rouge video conference. “Sorry for the brief interruption,” I addressed the grid of eight participants—Lennon, Reed, two newly hired site superintendents, three equipment vendors. “Let’s lock the 1.1‑million‑square‑foot expansion package.”

Reed screen‑shared the updated financial model—phased capital expenditures over eighteen months, projected internal rate of return exceeding 22%, sensitivity analysis on fuel surcharge volatility. Lennon scrolled to the incentive rider.

“Economic development authority confirmed the ten‑year payment‑in‑lieu‑of‑taxes agreement—seventy‑five percent abatement year one, stepping down five percent annually.”

A vendor representative inquired about electrical infrastructure. “Redundant utility feeds?”

“Dual substation transformers specified in the RFP,” I said. “Uninterruptible power supply covering all automated sortation lanes.”

We advanced slide by slide—target occupancy third quarter, initial revenue recognition fourth quarter, positive cash flow month eight post go‑live. By 10:51 a.m., the term sheet was pristine. Lennon generated DocuSign envelopes and distributed links to each party. Electronic signatures arrived in order—Landlord Entity, KS Advisers LLC, local power cooperative. Transaction sealed.

I powered down the laptop at 11:04. The board line showed zero missed calls. Dad’s mobile displayed no new texts. Phase Two, fully capitalized.

Three weeks later, Thursday, 11:00 a.m., the Memphis Warehousing Symposium filled the Marriott Grand Ballroom with over five hundred supply‑chain executives, badge lanyards clacking against coffee cups. I mounted the main stage beneath a crisp KS Adviser banner in navy and silver. No trace of the old family logo anywhere in sight.

Craig Brooks delivered the introduction four minutes prior—Apex National Vice President of Distribution—speaking in measured corporate tones. Zero reference to Shaw Riverfront.

I advanced the remote to the opening slide. “Apex National fulfillment framework: twenty‑million‑dollar, three‑year master services agreement. Apex National designates KS Advisers as sole LSP and routing optimization provider for twenty‑eight strategic nodes nationwide. Projected annual volume: forty‑two million cartons processed. Fixed base rate with built‑in performance escalators tied to on‑time delivery and damage‑free metrics.”

The next screen displayed the continental map—twenty‑eight red pins stretching from the Laredo cross to the Newark high‑velocity hub. “Phase One activation: 2.4 million square feet operational by first quarter. Full national footprint live by fourth quarter next calendar year.”

Polite but enthusiastic applause swept the room. Smartphone cameras angled upward.

Craig ascended the three steps to join me, thick contract folio tucked under one arm. We positioned at the signing table draped in black linen. Dual pens—his and mine—moved in unison across the execution blocks. The notary pressed her embossed seal beside each signature line. Twenty million committed. We exchanged the standard grip‑and‑grin for the official photographer, then stepped aside as the moderator announced the next panel.

By 1:18 p.m., my advanced team had claimed the new East Memphis headquarters—3,200 contiguous square feet on the eighth floor of the Crescent Center tower, floor‑to‑ceiling glass offering an unobstructed southern vista of the river bend. Reed orchestrated the fiber‑optic technicians threading Cat‑6 through the raised‑floor grid. Lennon mounted the freshly issued Tennessee LLC certificate in a brushed‑steel frame beside the frosted‑glass reception desk. I toured the layout—twenty open‑plan workstations with dual 27‑inch monitors; three glass‑walled conference pods equipped with 4K video bars; one dedicated war room housing four 85‑inch dashboard screens already cycling real‑time KPI feeds.

The vendor coordination sheet listed Shaw Riverfront Logistics in column F—designated ancillary carrier, spot‑market overflow only. No dedicated lanes, no priority routing, no master lessor status. Pure support contractor.

I pulled up the live revenue pipeline—Apex National contract already contributing 1.8 million in projected monthly recurring billings, trending upward with seasonal ramp. Updated pro forma flashed green—capital recovery month four, targeted EBITDA margin 28% in the inaugural fiscal year, scaling to 33% by year three.

My mobile vibrated—local 901 prefix, unknown contact. I swiped to voicemail. Immediate follow‑up text from Reed: Legacy HQ just submitted desperate RFP for excess capacity. Attached rate sheet demands 40% market premium.

I typed: Counteroffer at 55% surcharge, net‑10 terms, cash in advance.

His response: thumbs‑up emoji plus exploding‑head gif.

By 4:42 p.m., the office pulsed with controlled energy—laser printers spitting addenda, junior analysts stress‑testing lane simulations, compliance officer uploading hazardous materials endorsements to the state portal. I paused at the corner window, sunlight glinting off the slow‑moving barge traffic eight stories below. Shaw Riverfront had been relegated to subcontractor status within its original geographic stronghold. KS Advisers now commanded the entire value chain.

Two months later, Friday, 12:30 p.m., the Peabody Hotel lobby echoed with the familiar quack of the daily duck march as the red‑carpeted procession crossed toward the fountain. I navigated the marble expanse in measured steps, blazer buttoned, toward the arched entrance of Chez Philippe.

Patricia rose from a secluded corner table the moment she spotted me, her double‑strand pearls shifting against the cream silk blouse, iced tea already waiting in tall crystal glasses.

“Kendall, darling,” she said, extending both hands. “Thank you for accepting the invitation on such short notice.”

I allowed a brief clasp before sliding into the opposite velvet chair. The maître d’ poured my tea without consultation, a lemon wedge balanced on the rim. Patricia settled back, napkin smoothed across her lap.

“Your father and I have discussed this at length. We owe you a profound apology. The board decision was impulsive. Eastston acted without full context. We should have insisted on dialogue before any vote.”

I rotated the lemon clockwise with the silver spoon. “The vote is recorded. Contracts have migrated. Apologies don’t reverse executed agendas.”

She scanned the elegant room—white‑jacketed waiters gliding between linen‑draped tables—then lowered her volume. “He’s overwhelmed. Key accounts are terminating. He recognizes the miscalculation.”

The waiter presented Maryland crab cakes on chilled plates. I sliced one precisely. “Eastston demanded authority,” I said. “Authority granted. Market response is the natural audit.”

Patricia’s manicured fingers tightened around her glass. “Family legacy isn’t an audit line. We taught you loyalty, respect, continuity.”

“You taught me to construct value.” I set the knife parallel to the plate. “I constructed. The framework exceeded the original blueprint.”

She leaned forward, voice softening. “Sunday dinner at the house. No agendas, just the four of us.”

“I remain a Shaw, Mom. But the Shaw you envisioned isn’t the one across from you.”

Her breath caught, eyes searching my face for the child she remembered. I signaled the waiter, signed the member charge slip, and rose. “The duck l’orange is excellent this season.” I turned, heels clicking across polished terrazzo past the fountain’s splash, and exited into the afternoon sun without glancing back.

Six months later, Tuesday, 8:00 a.m., the East Memphis war room glowed with green metrics. KS Apex Solutions—my rebranded national platform—posted eighteen million trailing twelve‑month revenue, up forty‑one percent quarter over quarter.

Reed slid the printed P&L across the table. “Apex National alone drives sixty‑two percent. Covenant and Delta round out the rest.”

I initialed the bottom corner. “File with the auditors. Schedule the Series A pitch for Q1.”

Lennon entered, tablet in hand. “Breaking alert: Shaw Riverfront just announced a thirty percent headcount reduction. Effective immediately.”

The room quieted. Analysts paused mid‑keystroke. Reed pulled up the press release on the main screen.

“Cites portfolio realignment and market contraction,” he read. “Stock down eleven percent pre‑market.”

I scanned the bullet points. No mention of client exodus. No admission of lost leases.

Another notification pinged—internal memo from the old HQ, forwarded by a remaining contact. Subject: Leadership Transition. Eastston Shaw stepping down as CEO, returning to consulting capacity. Board appoints interim from outside.

“They’re cauterizing the wound,” I said.

Reed leaned back. “Thirty percent cut means what? Two hundred heads.”

“Two hundred twelve,” Lennon corrected. “Mostly ops and middle management. Sales team gutted last month.”

I stood and walked to the window. The Mississippi rolled wide and brown below, barges strung like beads. Eighteen million in new billings. Thirty percent workforce slashed at the legacy firm. Eastston sidelined.

“Loyalty has value only when it’s earned,” I said to the glass.

The river kept moving.

News

At Thanksgiving dinner, my husband pointed at me and gave a mocking little laugh, calling me “invisible dead weight” in the middle of everyone’s laughter at the table, so the next morning I left the house, the paperwork, and even my wedding ring behind, traveled nearly 6,000 miles to Alaska to rebuild my life, only for him to show up at my door on the very day I opened my little empire, like a guest who had never been invited.

The cranberry sauce was still warm in my hands when my husband destroyed thirty-five years of marriage with seven words….

At my son’s wedding, they sat me outside, right next to the trash cans and the kitchen door. My daughter-in-law just curled her lip and hinted that I’d long since gotten used to being treated badly. I quietly picked up the wedding-gift envelope and slipped away, so that exactly one hour later, the whole reception hall was suddenly in an uproar when the groom realized the most secret and most valuable gift had suddenly disappeared.

No mother dreams of watching her only son get married from beside the garbage bins. But there I was in…

My daughter gave us a multimillion-dollar villa, but the first thing my husband did was demand a divorce with a cold, arrogant attitude; my daughter and I just quietly looked at each other in silent understanding, and ten minutes later he was the one turning pale, dropping to his knees, desperately begging for forgiveness.

There are moments in life that change you forever. Moments that divide your existence into a before and an after….

After a suffocating argument in the car, my son casually told his 67-year-old mother to get out at a bus stop, leaving me under the blazing noon sun with no money and a dying phone, thinking this “independence lesson” would force me to beg for forgiveness, never imagining that just a few minutes later, a mysterious man would appear, invite me into his luxury car, and quietly teach that ungrateful son a lesson he’d regret for the rest of his life.

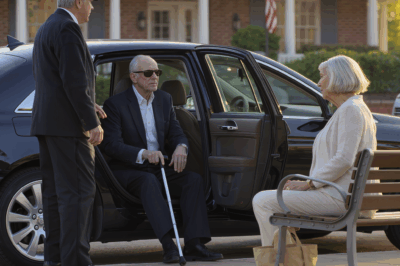

After an argument, my son left me at a bus stop with no money. A blind gentleman whispered, “Pretend you’re…

My daughter-in-law looked me straight in the face and said, “Tonight you pack your things and move out, there’s no place for you here anymore.” She had no idea the apartment on the floor right above was in my name, and that that night I would be the one deciding who was allowed to stay in this home. That was the night their whole married life really flipped upside down.

The Waterford crystal hit the kitchen counter with a sound that made my heart skip. Not shattered, thank God, but…

At my son’s elegant charity gala in the U.S., he laughed and put me up for auction in front of 200 guests: “One dollar for the boring mom who just sits at home writing stories all day, anyone want her?” The whole room went dead silent, until a stranger in the very last row suddenly stood up, bid one million dollars, and said one sentence that made his face go white.

My own son stands up at a charity gala and decides to auction me off for $1 in front of…

End of content

No more pages to load